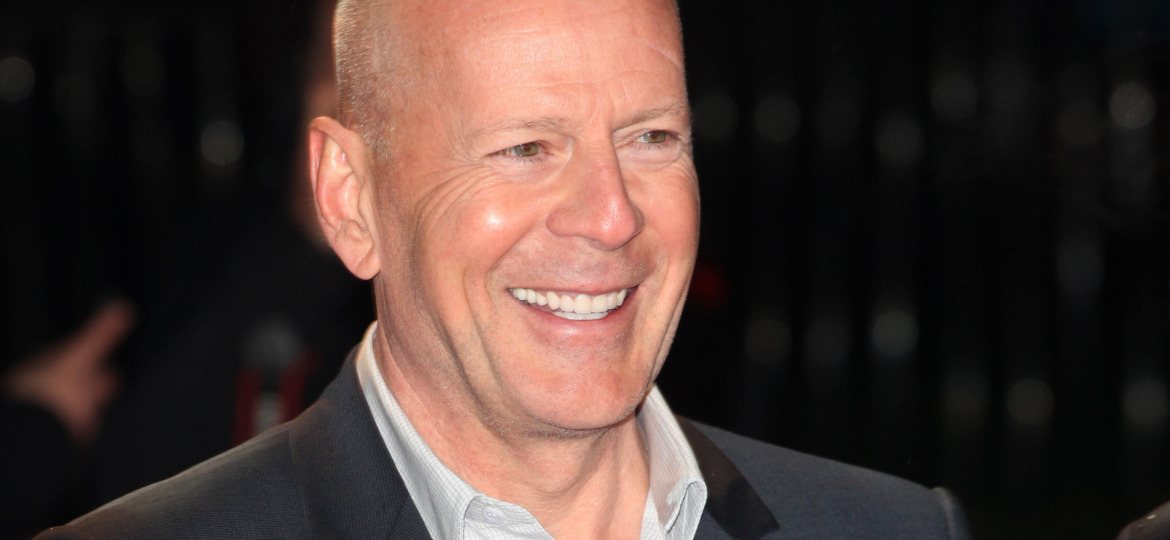

Bruce Willis was diagnosed with dementia earlier this year. This diagnosis can be extremely gut wrenching for the entire family, including but certainly not limited to, the individual suffering with dementia. Many people only think about estate planning in the context of death and transfer of assets, but perhaps even more important is planning for the eventuality of incapacity.

Once a person’s capacity deteriorates to a certain degree, that individual no longer has the ability to put in place legal documents and appoint agents of their choice. If some lack’s capacity to execute documents, then loved ones could be hamstrung and unable to help in many important ways. This problem is the same for anybody who may suddenly lose capacity due to an accident, a stroke, or any other number of parade of horribles.

Without a successor trustee, or agents under powers of attorney, family cannot easily access your bank accounts, access your tax returns, sign checks, or speak on your behalf with medical professionals. At that stage, the only recourse for the family to gain access and control is through Probate Court – filing for a conservatorship (which is called a Guardianship in many states outside of California). which is an extremely expensive and lengthy process.

A conservatorship is a legal arrangement in which a court appoints a conservator to manage the personal and/or financial affairs of an adult who is unable to manage them on their own due to physical or mental incapacity. While a conservatorship can provide a valuable safety net for vulnerable individuals, there are several potential downsides to consider, particularly in the State of California. A conservatorship involves filing a petition with the court, seeking appointment of a legal caregiver to make decisions on behalf of the individual. A conservatorship is a costly and complex legal endeavor that involves court fees, attorney fees, and ongoing reporting requirements. While the court appoints a conservator to manage the affairs of the individual, that individual must report back to the court and typically also has to post a bond. Accountings are typically filed and reviewed by the court annually, causing a filing fee, and many other associated costs including potentially accounting professional fees and legal professional fees, as well as fees for the conservator serving.

It is important to note that conservatorship may be necessary and appropriate in some cases, particularly in situations where there are no other viable alternatives for managing an individual’s affairs. However, it is important to carefully consider the potential downsides and consult with an attorney or other qualified professional to explore all available options for managing incapacity.

Here are some steps that individuals can take to plan for incapacity (thus avoiding a conservatorship):

Establish a durable power of attorney: A durable power of attorney is a legal document that designates someone to make financial and legal decisions on your behalf if you become incapacitated.

1.Create a healthcare power of attorney: A healthcare power of attorney designates someone to make medical decisions on your behalf if you are unable to do so.

2.Create a living will: A living will is a legal document that outlines your wishes for medical treatment and end-of-life care.

3.Organize your financial and legal affairs: It is important to organize your financial and legal affairs so that they can be managed easily by your designated power of attorney in the event of your incapacity.

4.Communicate with loved ones: It is important to have open and honest conversations with family members and loved ones about your wishes and plans for incapacity, as well as for death and burial.

5.Create a trust: A trust is a legal arrangement that allows you to transfer assets to a trustee who manages them for the benefit of your beneficiaries. This can help ensure that your assets are managed properly if you become incapacitated.

IF A BAD DIAGNOSIS EMERGES, WHAT SHOULD YOUR FAMILY DO:

It is important to consult with an attorney or other qualified professional to ensure that your plans for incapacity are properly established and legally valid. Additionally, it is important to review and update your plans regularly to ensure that they continue to reflect your wishes and circumstances. If the disability is something that is progressive, there may be time to put in place documents or update them such that you can avoid a conservatorship and other hardships down the road.

1.Seek medical advice: If an individual is experiencing memory loss or other symptoms of dementia, they should consult with a qualified healthcare professional for an evaluation and diagnosis.

2.Discuss plans with loved ones: It is important to have open and honest conversations with family members and loved ones about one’s wishes for care and support in the event of a dementia diagnosis.

3.Consider legal and financial planning: Individuals may want to consult with an attorney to establish a power of attorney or other legal documents that can ensure their wishes are respected and their affairs are managed appropriately.

4.Create a support network: Dementia can be a challenging diagnosis, both for the individual and their loved ones. Creating a support network of friends, family, and healthcare professionals can help individuals with dementia and their loved ones navigate the challenges ahead.

It is important to note that planning for a potential dementia diagnosis is a complex and often emotional process. Consulting with healthcare professionals, legal experts, and other qualified advisors can help individuals and their loved ones make informed decisions and ensure that their wishes are respected.

Here is a more complete article related to Mr. Willis’s diagnosis:

https://www.bu.edu/articles/2023/what-now-for-bruce-willis-after-actors-recent-dementia-diagnosis/

Testimonials

Charities We Support

We dedicate pro bono time, volunteer services, and a percentage of our gross revenue to these organizations. In 2023, we sponsored a refugee family of five to come to the United States and start a new life.

Each year our law firm decides as a group which charities to assist with our time, money, and expertise. Please feel free to click on any of the charities below and make a donation of your own.